What’s worse, the most vulnerable are disproportionately affected. And thriving businesses, especially small businesses, can be brought to their knees, hurting employers and employees. Families must contend with depleted savings and making painful choices among life’s necessities. A generation of young people seeking to enter the workforce may find it daunting or even impossible. But as we have seen in most recessions, the existing automatic stabilizers are not nearly enough.

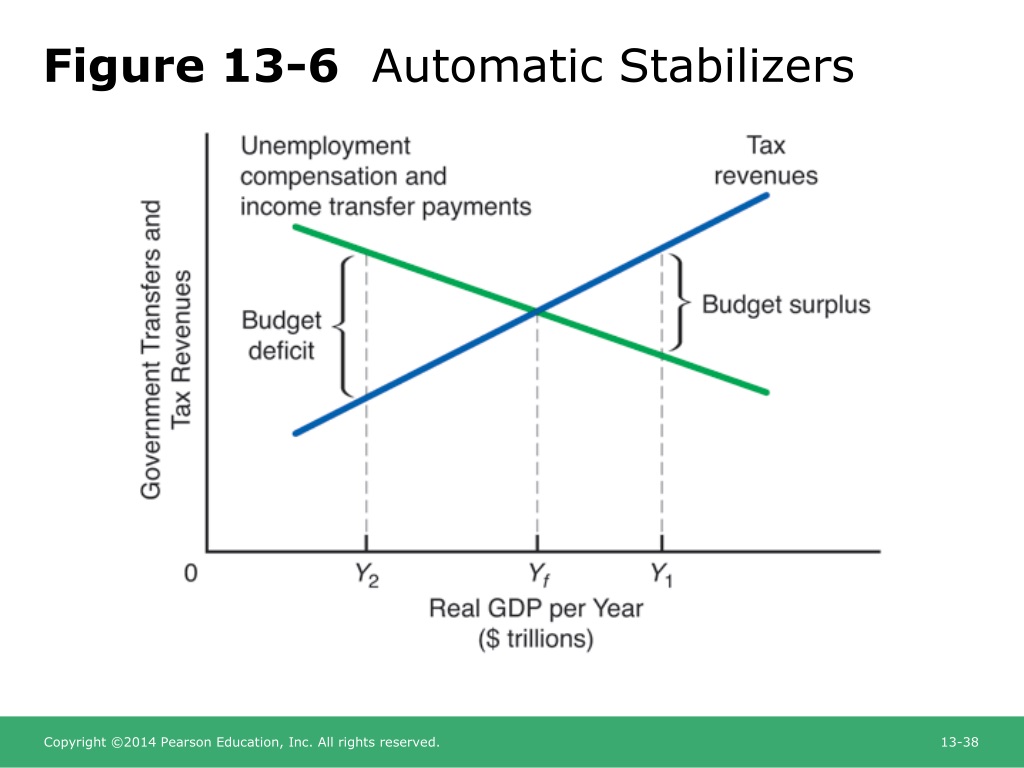

These results are important not only for families but also for the overall economy, which desperately needs the injection of greater resources. When a recession hits, the tax system and a number of key programs, from Unemployment Insurance to Medicaid, already cushion its effects by giving families suffering from unemployment or underemployment greater resources to cushion the blow or, in the case of the tax system, taking less (or nothing) in taxes. Recession Ready was edited by Equitable Growth Executive Director Heather Boushey, Ryan Nunn, a fellow in Economic Studies at the Brookings Institution and policy director for The Hamilton Project, and Jay Shambaugh, director of The Hamilton Project, senior fellow in Economic Studies at the Brookings Institution, and professor of economics and international affairs at the Elliott School of International Affairs at The George Washington University.Īutomatic stabilizers for the economy are anything but a new concept. In a new book, Recession Ready: Fiscal Policies to Stabilize the American Economy, experts from academia and the policy community propose six big ideas, including two entirely new initiatives and four significant improvements to existing programs, all to be triggered when the economy shows clear, proven signs of heading into a recession. What are the best policies to put in place today? Policymakers need a guide, and Equitable Growth has joined forces with The Hamilton Project to advance a set of specific, evidence-based policy ideas for shortening and easing the impacts of the next recession. But policymakers can ameliorate some of the next recession’s worst effects and minimize its long-term costs if they adopt smart policies now that will be triggered when the first warning signs of the downturn appear. And they are painful, with harsh short-term effects on families and businesses and potentially deep long-term ill effects on the economy and society. Having occurred seven times in the past 50 years, recessions-like death and taxes-are inevitable. economy is cruising down the road in high gear, as it is these days, it can be hard to focus on the next engine failure.

0 kommentar(er)

0 kommentar(er)